Don’t invest unless you’re prepared to lose all the money you invest. This is a high - risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more

Guide to Litigation Funding

[Litigation] funding is beneficial and should be supported. It promotes access to justice.

Lord Justice Jackson, 2011

Litigation Funding Market Overview

Introduction

Litigation funding is the financing of legal cases by third parties in return for a defined share of the proceeds (costs and damages). In this way legal claims can be regarded as a financial asset just like stocks, bond, property or commodities but with their own unique risk/ return profile.

Litigation funding offers investors the opportunity to diversify their portfolio by participating in a new asset class that is not correlated with traditional market instruments such as equities, bonds, property or commodities.

Brief History

Traditionally, litigation funding has been viewed as opaque under the law in many jurisdictions. In England the concepts of maintenance, champerty, and barratry – in essence third party financing of legal claims, were made illegal from medieval times to prevent them being exploited by the wealthy to fund frivolous claims against their adversaries.

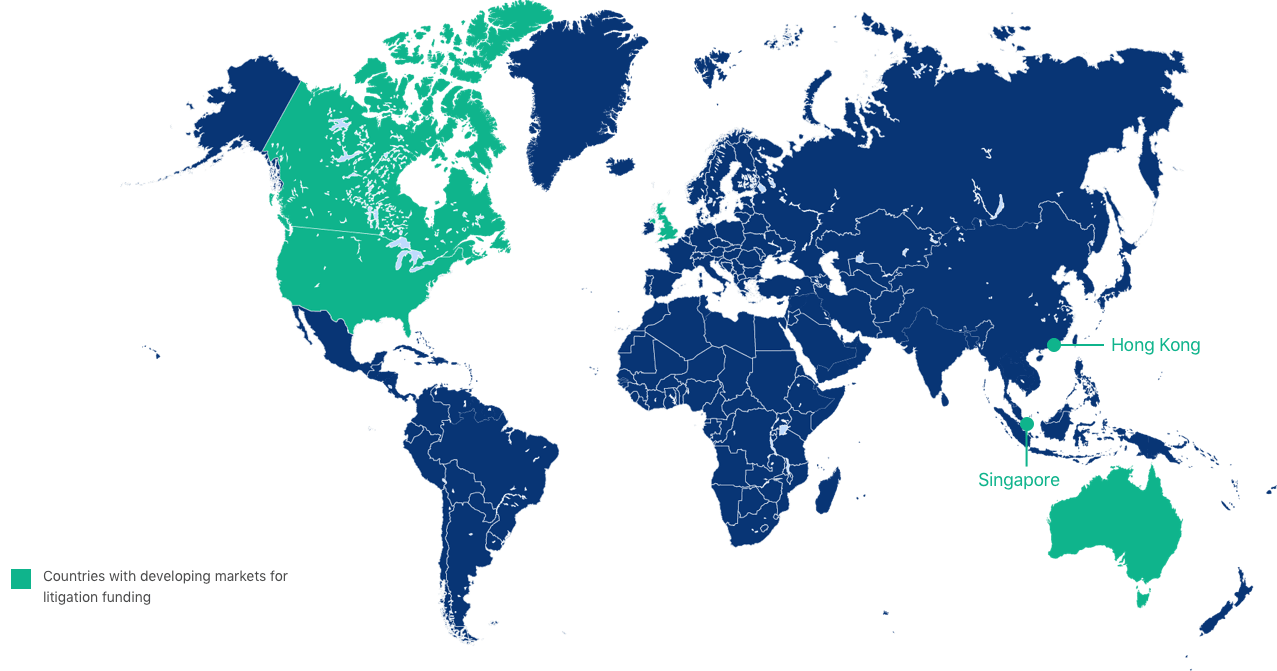

However, in the past 30 years, litigation funding has started to gain widespread acceptance around the world with countries such as Australia, the US and UK, the leaders in this regard.

More recently jurisdictions including Canada, Hong Kong and Singapore have introduced legislation supporting the financing of legal claims indicating a trend towards wider adoption.

Litigation funding ("champerty") made illegal in UK

Criminal Law Act: Champerty / litigation funding abolished as a crime and a tort

CFAs (Conditional Fee Agreements) approved

IMF Bentham listed on Australian Stock Exchange

Case of Arkin v Borchard Lines shows UK legal system sympathetic to position of litigation funders

Augusta Ventures incorporated

Burford Capital IPO

Jackson Review of England & Wales Civil Litigation Costs (supporting litigation funding)

Founding of UK Association of Litigation Funders, with support from UK Ministry of Justice

Damages-Based Agreements for lawyers approved

LexShares launch (US based litigation crowdfunding platform)

CrowdJustice launched (public interest litigation - pledge backed)

Capital Dispute Finance launched by Cardiff-based Capital Law

UK & US Markets for Litigation Funding

The addressable markets in the UK and US are large and still relatively under-penetrated. In the UK, the litigation funding market has quadrupled in size since 2013 with over £1bn of capital estimated as currently available to litigation finance and at least 12 players competing across different market segments.

However, this still only represents a small fraction of the overall UK market for legal services (£30bn[1]). Meanwhile in the US, the total litigation market size is around US$200bn[2] and third party financing of litigation is estimated to only account for only 2%[3] of this.

Growth Drivers for Litigation Funding

There are a number of reasons for the recent growth in litigation funding. Foremost was the shift in the legal and regulatory position. In the UK this commenced in the late 1960s with the Criminal Law Act which abolished criminal and civil liability for champerty along with several other similar offences. This was then further confirmed under various case law and reforms of the legal system, including those recommended by Lord Jackson in 2011, which formally recognised the fact that third party litigation funding enables greater access to justice for litigants and in doing so provides a “social good”.

Litigation funding can be seen as a response to a growing need for finance by claimants – particularly with the growth both in the numbers of cases and the cost of litigation.

Litigation funding can in many ways simply be seen as an expansion of the traditional contingency model. Lawyers have long been taking cases on a contingency basis that have merit but would not otherwise get to trial. But law firms, increasingly frequently, don’t have the capital or risk appetite required to provide the necessary funding.

Funding is needed for a variety of purposes. In the UK, the loser in a litigation case is liable for the costs of the other party. To mitigate this risk, insurance is often purchased – so called After the Event (ATE) Insurance. The premiums for this insurance are often considerable and add significantly to the total cost of litigation. Litigation Funding is often used to pay for this insurance. In addition, the discovery-related expenses associated with a legal action (in addition to the lawyers’ fees) can be challenging for a claimant to self-fund.

The arrival of litigation funding in the market helps supply this required capital and means that lack of funding is less likely to impede a claim that would otherwise be viable. For investors, potential returns seem likely to remain high until the market becomes more mature.

£32.7bn

Total UK Market for Legal Services in 2017

~£1bn

UK Investment in Litigation Funding by Major Players

Source: UK Law Society and ResearchAndMarkets.com

[1]UK Law Society Report “Legal Services Sector Forecasts 2017-2025”; ResearchAndMarkets.com Report “UK Legal Services Market Report 2018”

[2]Media sources; estimates based on public filings

[3] Estimate based on public filings

Get notified

of new investment opportunities and news